About

Perspectives on The Real Economy

One of @huffpostbiz 26 Economists You Should Be Following. Jazz lover. Wine enthusiast. Cigar aficionado, USC Trojan.

Perspectives on The Real Economy is the blog written by RSM US LLP Chief Economist Joe Brusuelas. The opinions here are his own.

Investors May Be Underestimating Positive Supply Shock

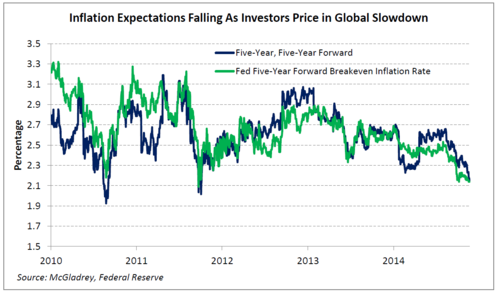

U.S. inflation expectations declined today after a rough morning of foreign manufacturing data and the release of the October consumer price index. In part, this move reflects the fact investors are pricing in a further deceleration in global economic activity amid recession in Japan and the risk of deeper slowdowns in Europe and China.

Those global risks aside, investors may be misinterpreting what is actually taking place in the U.S. The positive productivity shock in the energy and technology sectors, while inherently disinflationary, also carries with it significant positive implications for the economy related to consumption, growth and efficiencies in production.

This is a scenario where falling prices don’t warrant further monetary policy accommodation, which means the Fed will probably continue to move along the path it has signaled to investors during the past few months.

Meanwhile, core consumer prices appear to have stabilized despite a sharp drop in the cost of energy. Falling inflation expectations therefore won’t deter the Fed from taking the first tentative steps in the normalization of policy and in preparing firms that operate in the real economy for a 2015 rate hike.

For additional information or insights from Joe Brusuelas, contact Terri Andrews at 704.877.1730.

financecontributors-blog liked this

financecontributors-blog reblogged this from joebrusuelas

joebrusuelas posted this